term life insurance policy

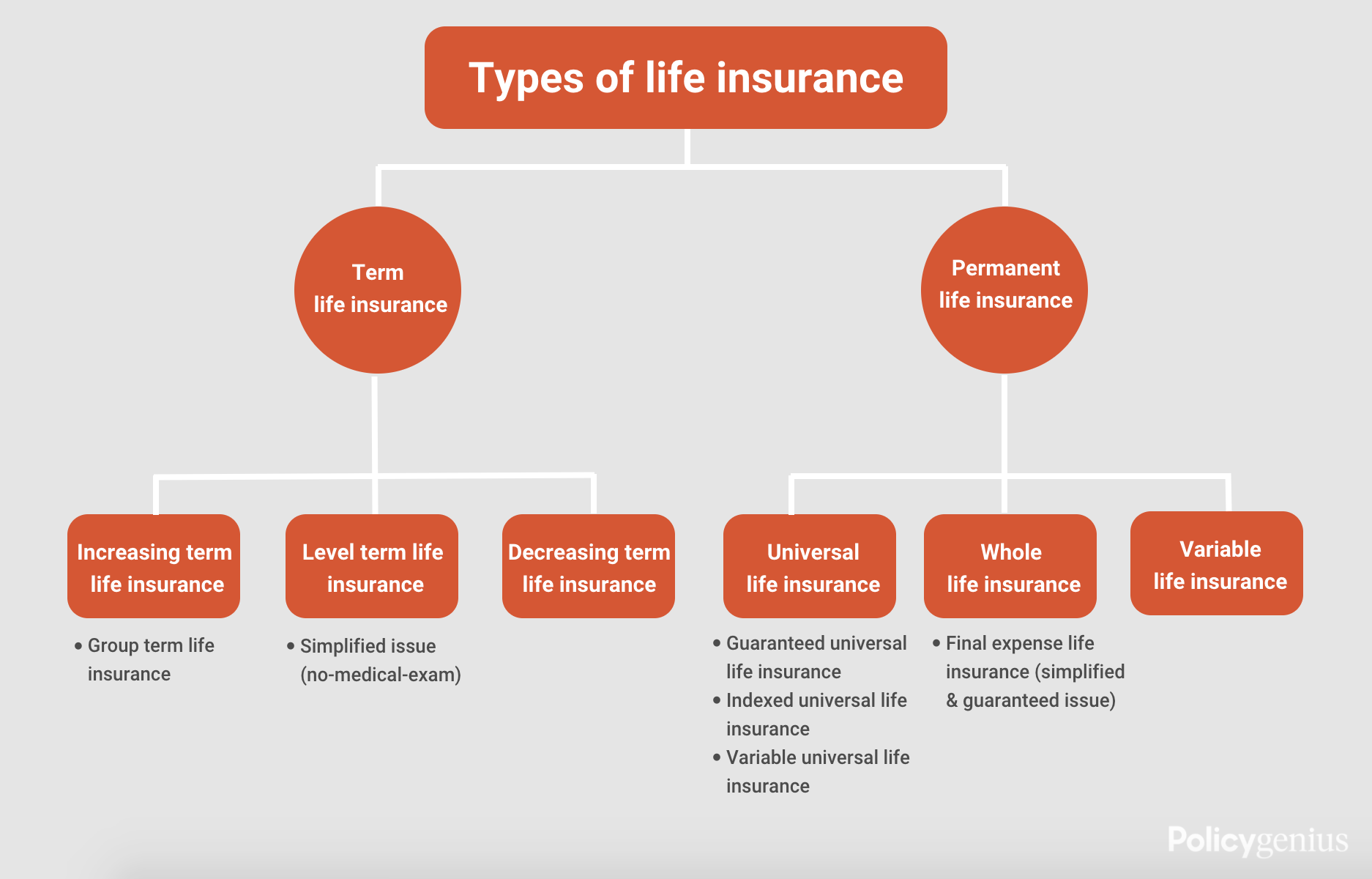

Term life insurance is a type of life insurance that lasts for a set period of time or the term. Two options for individual life insurance include a term life policy or a whole life policy which is sometimes called permanent life insurance.

The Complete Guide To Group Term Life Insurance Glg America

A term life insurance policy is only worth anything if the policyholder dies during the term.

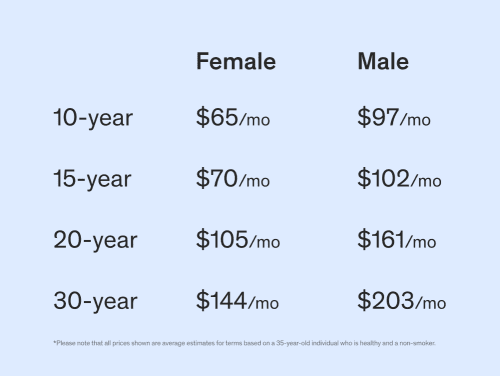

. The term can last anywhere from five to 40 years. There are permanent life insurance policies. Typically 10 15 20 or 30 years.

If the policyholder outlives the term the policy expires and is no longer worth. This is a unique type of term life insurance that works different to the others. You have the option to convert your coverage.

Rather than paying your beneficiaries with a lump sum this term life insurance type will pay. PolicyMe offers term lengths of 10 15 20 25 and 30 years which is standard for the life insurance industry. Term life insurance provides coverage for a specific period of time or term of years.

Term life insurance also known as pure life insurance is a type of death benefit thaOnce the term expires the policyholder can either renew it for another term conTerm life insurance guarantees payment of a stated death benefit to the insureds bThese policies have no value other than the guaranteed death benefit an See more. A Term Life Insurance policy from Prudential offers flexibility that can provide a lifetime of security. Nov 11 2021 A.

Term 80 is our longest coverage term. Convertible term life insurance can be a reliable solution when you are deciding between a term and a whole life insurance policy. Term life insurance rates best online term life insurance best term life rates best term life insurance for over 50 difference between term life and whole life term life insurance rates.

Lets say you have a house with a 30-year mortgage a 48-month auto loan and a college fund. Your term life policy can be converted to any of our permanent life insurance policies. The concept is simple.

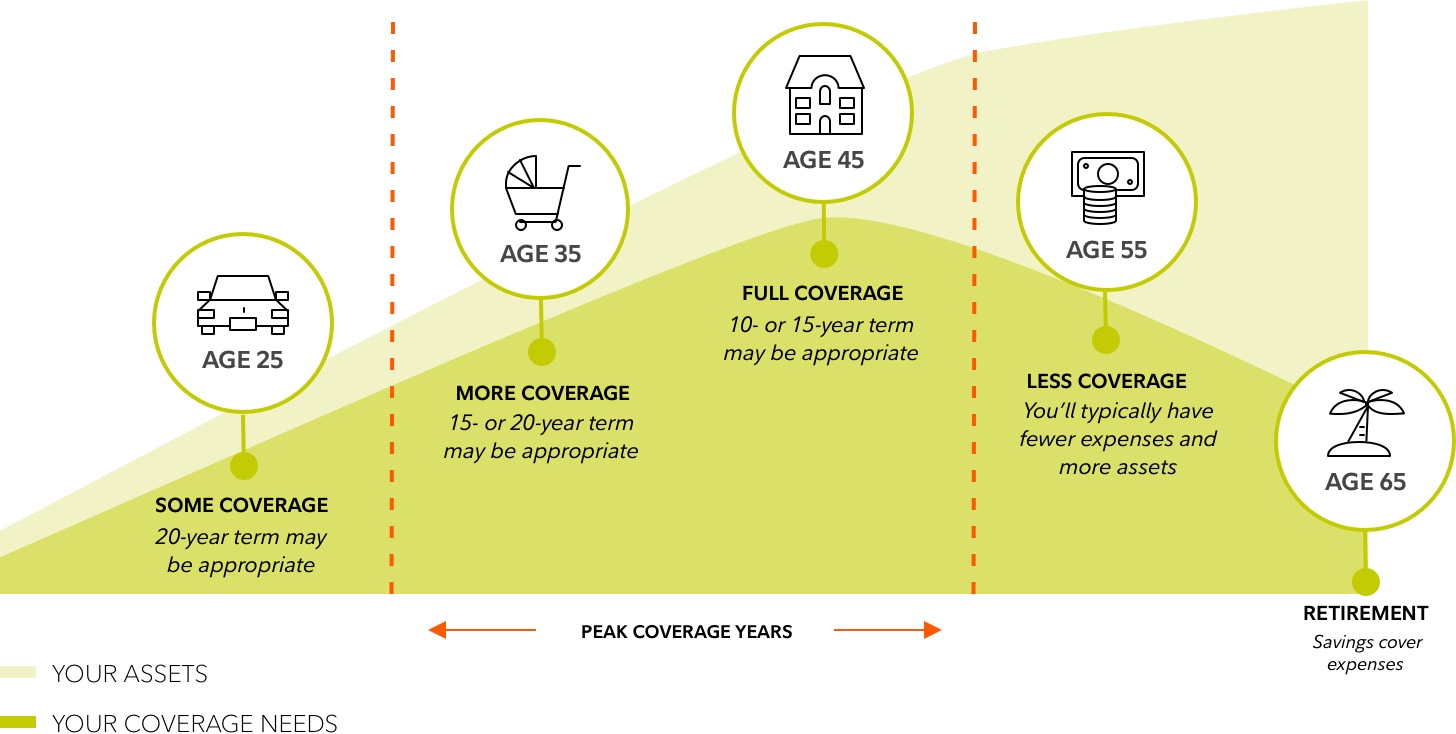

Term life insurance provides coverage for a specific amount of time. You have a growing family and the financial obligations that come with it. Its affordable and simple it may make sense if you only want protection for the years.

The key to term life insurance is the term -- if you die after the 20-year term expires your loved ones wont receive a payout. 10- 15- 20- and 30-year terms available. Annual renewable term life insurance gives you coverage at a lower initial cost but the premiums will increase every year as you get older.

If the insured person dies within the term of the policy and the policy is still in force active then. Term life insurance renewal is an option offered on many but not all term life insurance policies. This allows you to choose the best term for your needs without.

When you buy a term life policy that has a renewal option the policy will.

Million Dollar Life Insurance Policy Term Life Ethos Life

How To Buy Life Insurance In October 2022 Policygenius

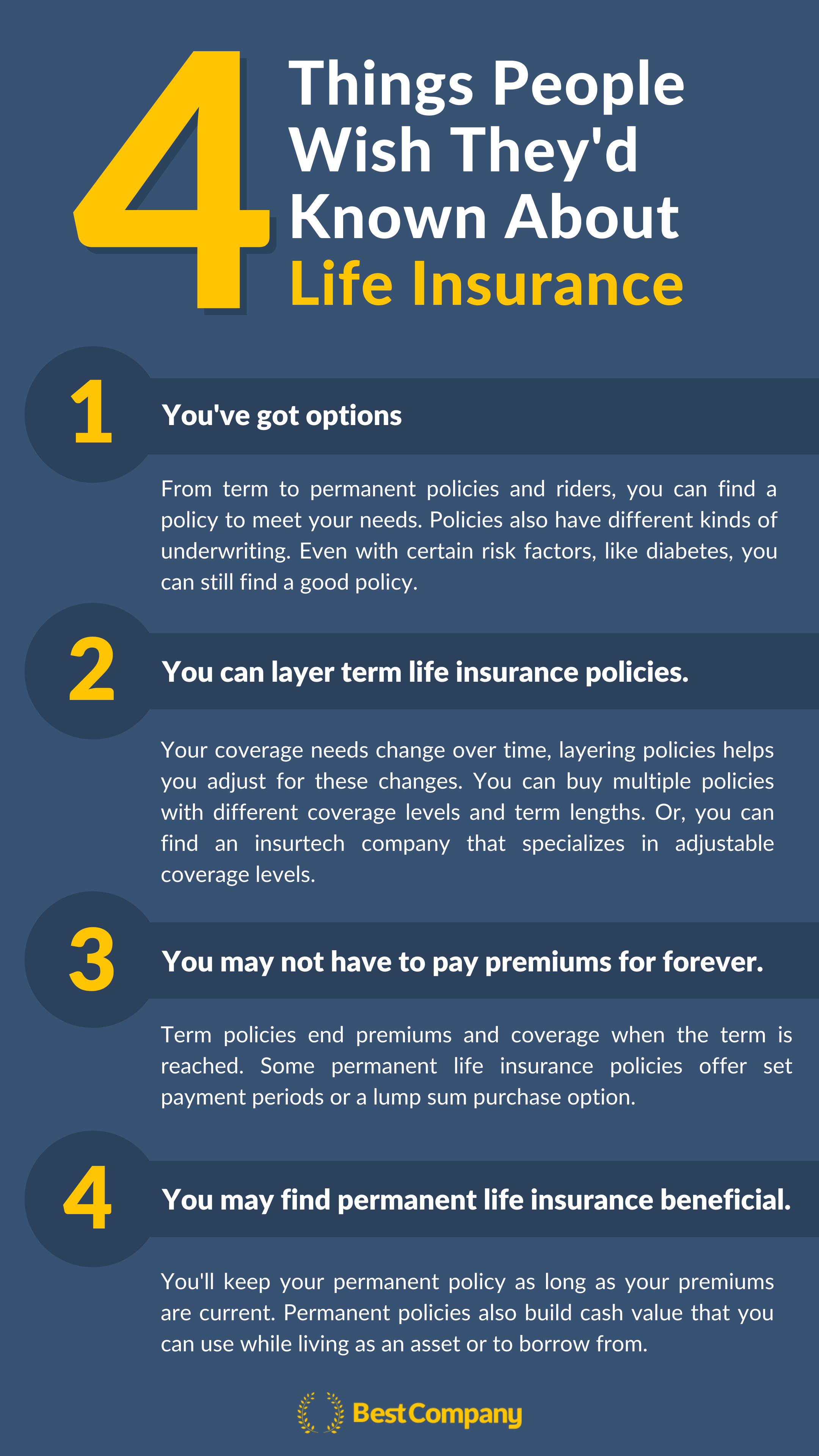

4 Things I Wish I D Known About Life Insurance Bestcompany Com

Compare Buy Best Term Life Insurance Policy For Your Life Stage Visual Ly

Can You Sell Your Term Life Insurance Policy For Cash

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

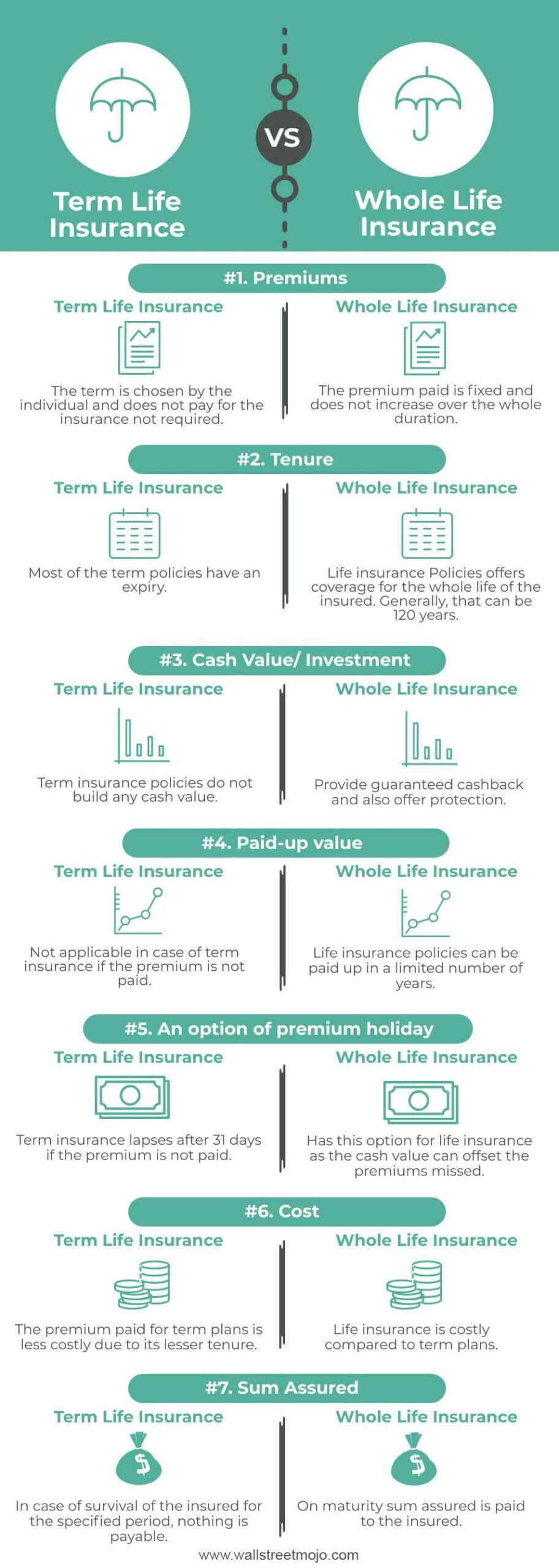

Term Vs Whole Life Insurance What S The Difference

What Is Term Life Insurance Banner Life Legal General America

What Type Of Life Insurance Policy Is Best For Me

Term Life Vs Whole Life Insurance Understanding The Difference

Term Life Vs Whole Life Insurance Which Insurance Is Better

Who Needs A 10 Year Term Life Insurance Policy

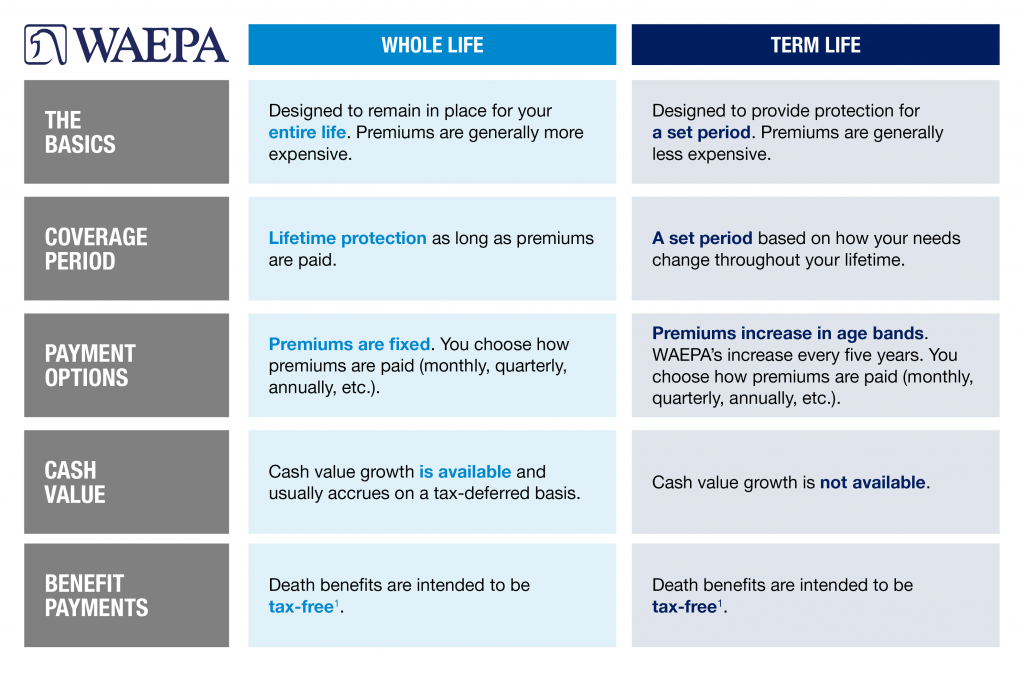

The Difference Between Term Whole Life Insurance Waepa

Individual Life Insurance Vs Group Term Life Insurance Fbsbenefits Com

Guaranteed Issue Life Insurance Policies Fidelity Life

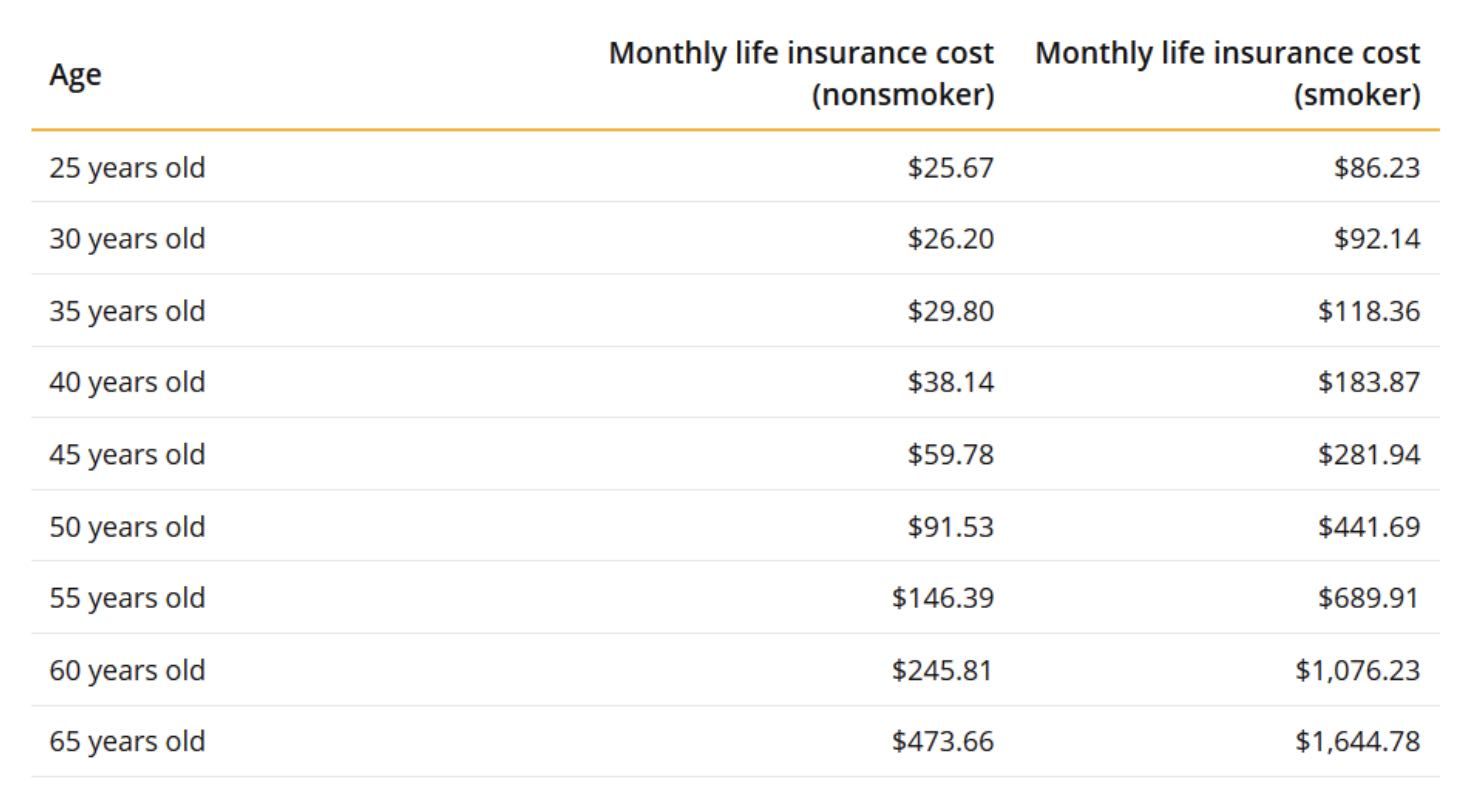

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

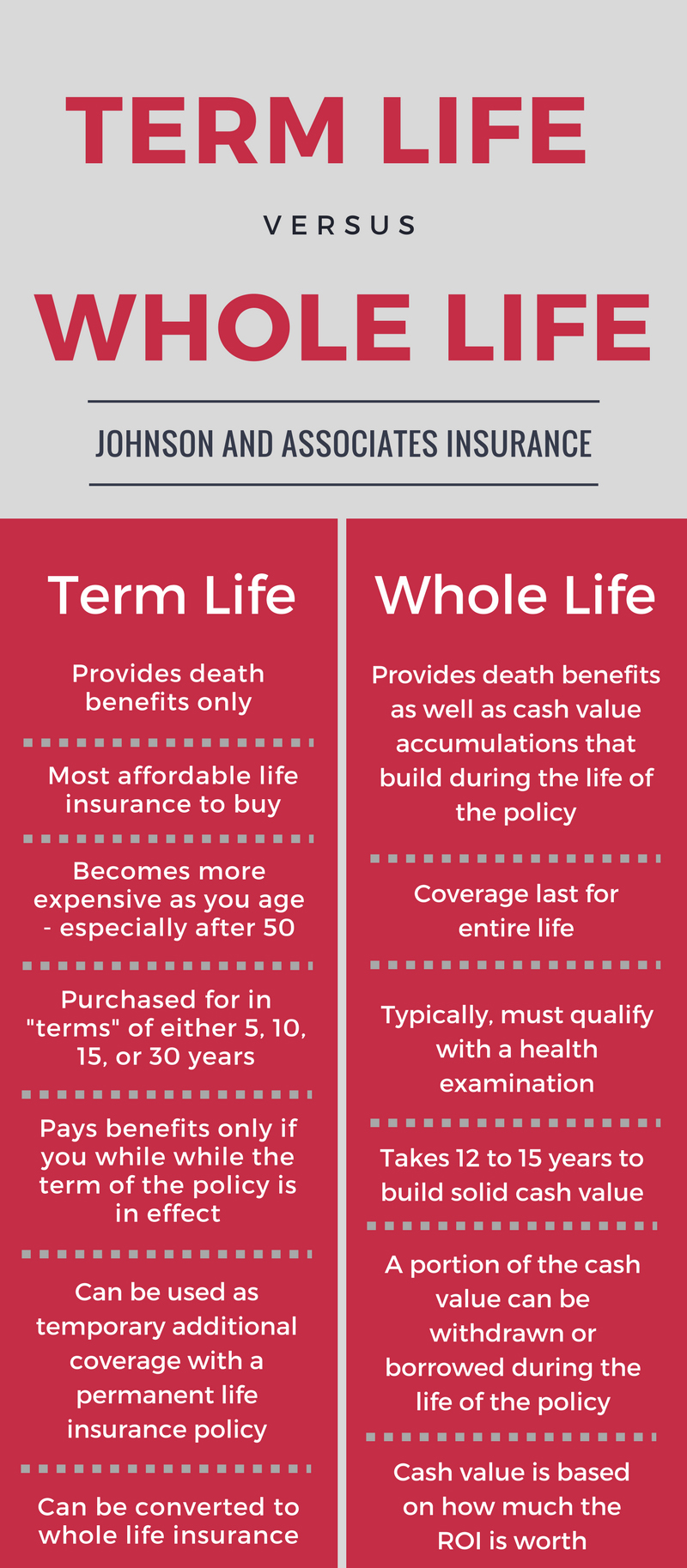

Term Life Insurance Vs Whole Life Insurance Johnson Associates Insurance

The Best Term Life Insurance Companies

Term Life Insurance Financial Resources Coverage Options Fidelity